Archive » 2024 » 2024.05. » Zöldréti, Attila – Herczegh, András - Vörös-Illés, Ivett – Páll, Zsombor Keywords: financial regulat: ANALYSIS OF NONPERFORMING LOANS IN DOMESTIC AGRICULTUREZöldréti, Attila – Herczegh, András - Vörös-Illés, Ivett – Páll, Zsombor Keywords: financial regulation, agricultural external financing, time se

ANALYSIS OF NONPERFORMING LOANS IN DOMESTIC AGRICULTUREZöldréti, Attila – Herczegh, András - Vörös-Illés, Ivett – Páll, Zsombor Keywords: financial regulation, agricultural external financing, time se

Zöldréti, Attila – Herczegh, András - Vörös-Illés, Ivett – Páll, Zsombor Keywords: financial regulat

Keywords: financial regulation, agricultural external financing, time series analysis, payment moratorium JEL.: G18, Q14, Q17

DOI: https://doi.org/10.53079/GAZDALKODAS.68.5.t.pp_430-444

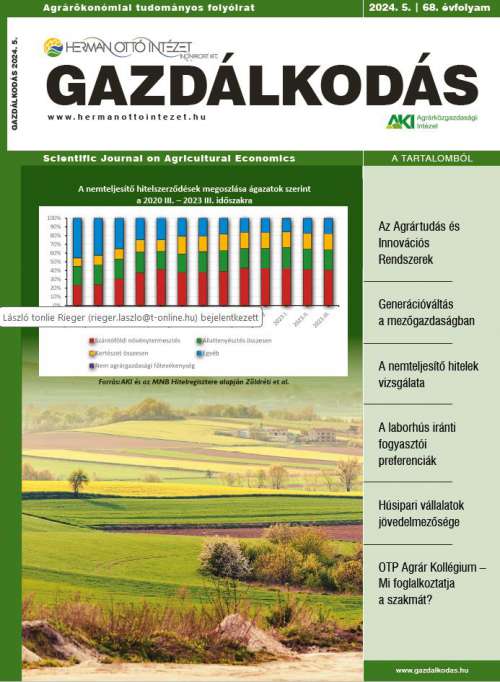

On 12 January 2024, the European Central Bank (ECB) published its third quarter 2023 report on banking supervision statistics for major institutions. The report notes that the non-performing loan (NPL) ratio remained stable at 2.27% in the third quarter. The Financial Stability Report of the Magyar Nemzeti Bank (MNB), published on 28 May 2024, shows a similar situation for Hungary, stating that the NPL ratio is low at the national economy level. The domestic rate in the corporate segment has stagnated, so overall portfolio quality remains good. This situation, thanks to a conscious and planned implementation by the EU - across all stakeholders - until 2020, led to a spectacular reduction in the NPL ratio This positive trend stopped in 2020, and after a trend reversal, its level stabilized with slight fluctuations. The study underpinning the present study had a dual objective. To explore the relationship between the recent increases in agricultural input and energy prices and the evolution of NPL, and to highlight the impact of this change on domestic agriculture. According to the authors' first hypothesis (H1), input and energy price developments show a significant relationship with NPL developments, despite market and non-market measures. According to their second hypothesis (H2), the domestic agricultural SME sector is the most affected by NPL change. The authors tested the plausibility of the first hypothesis by correlation analysis and the second by time series analysis. The results and conclusions of the analyses carried out confirmed the validity of both hypotheses, and the authors conclude that, in addition to further monitoring of the factors affecting the financial stability of domestic agriculture, the continuation of complex sectoral resilience building is highly justified in the future

Teljes cikk