Archive » 2014 » 2014. 4 » Lámfalusi, Ibolya – Péter, Krisztina – Tanító, Dezső – Tóth, Kristóf: The opportunity of value added tax reduction on agricultural and food products

The opportunity of value added tax reduction on agricultural and food products

Lámfalusi, Ibolya – Péter, Krisztina – Tanító, Dezső – Tóth, Kristóf

Keywords: VAT, VAT fraud, black economy, VAT rate on agricultural and food products

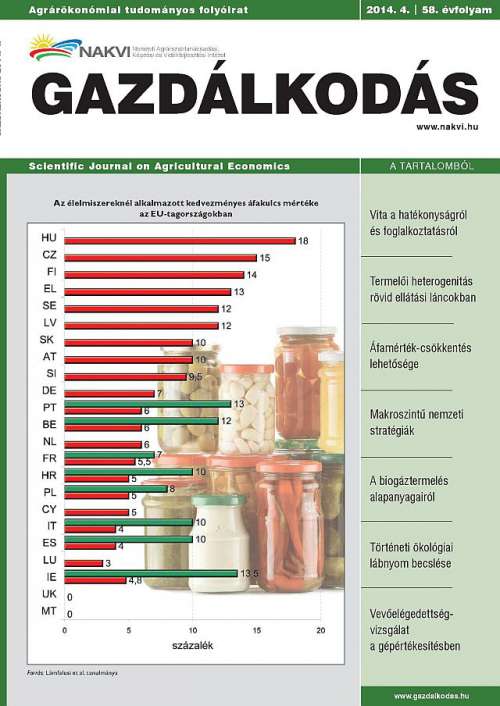

The standard and preferential value added tax (VAT) rates of 27 per cent and 18 per cent on agri-food products are extremely high in Hungary in comparison of other EU Member States as well as at international level. The high VAT rates have numerous ad-verse effects on economic development stimulating of VAT fraud and black trade, re-ducing transparency, impairing markets and causing huge moral and socioeconomic losses.

Making allowance for international experience and domestic possibilities we exam¬ined the options and effects of VAT rates reduction. The reduction of VAT rates would be benefit in case of basic foods, which amounts to over 50 per cent of total food con-sumption. Taking into account the EU VAT regulation, the domestic aspects of national budget as well as the economic effects aimed we consider a reduction of the preferen-tial VAT rate to 9-14 per cent to be feasible in the case of basic food products. As a re-sult of the measures outlined, the loss of revenue to the state budget is estimated to be HUF 128.8-209.6 billion. Our calculations suggest that this amount can be reduced to HUF 68.5 to 130.3 billion due to the other positive effects of VAT reduction.

Full article